corporate tax increase us

It was one reason that US. This measure also announces that from 1 April 2023 the Corporation Tax main rate for non-ring fenced profits will be increased to 25 applying to profits over 250000.

Corporate Tax In The United States Wikipedia

The corporation tax will increase to 25 from 1 April 2023 affecting companies with profits of 250000 and over.

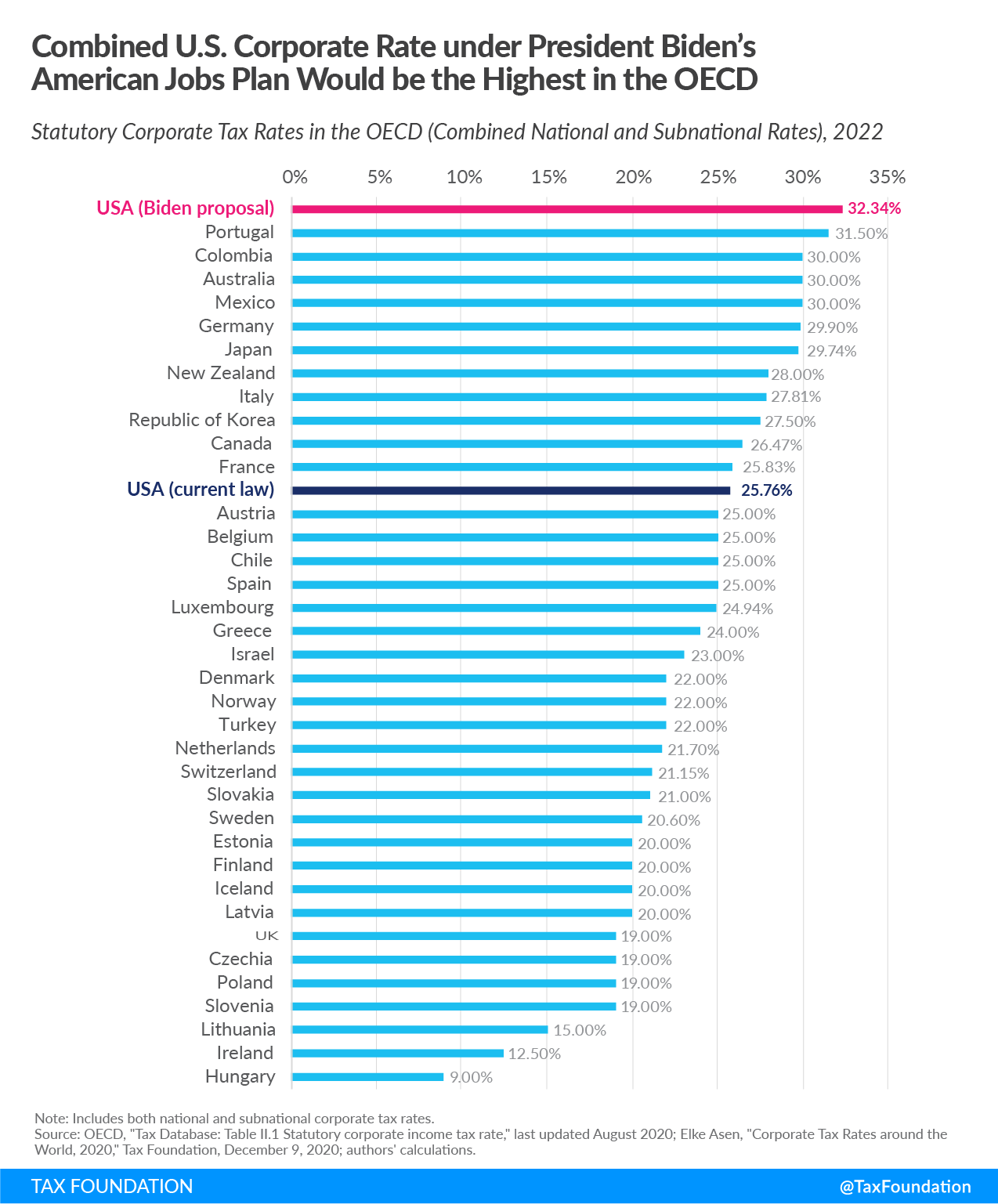

. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. Corporation Tax Rate Increase in 2023 from 19 to 25 As a result of the corporation tax rate increase the full rate of 25 will be applicable to businesses making. The administration said the increase would bring Americas.

The Chancellor has confirmed an increase in the corporation tax CT rate from 19 to 25 percent with effect from 1 April 2023. But Republicans are already. The plan announced by the Treasury Department would raise the corporate tax rate to 28 percent from 21 percent.

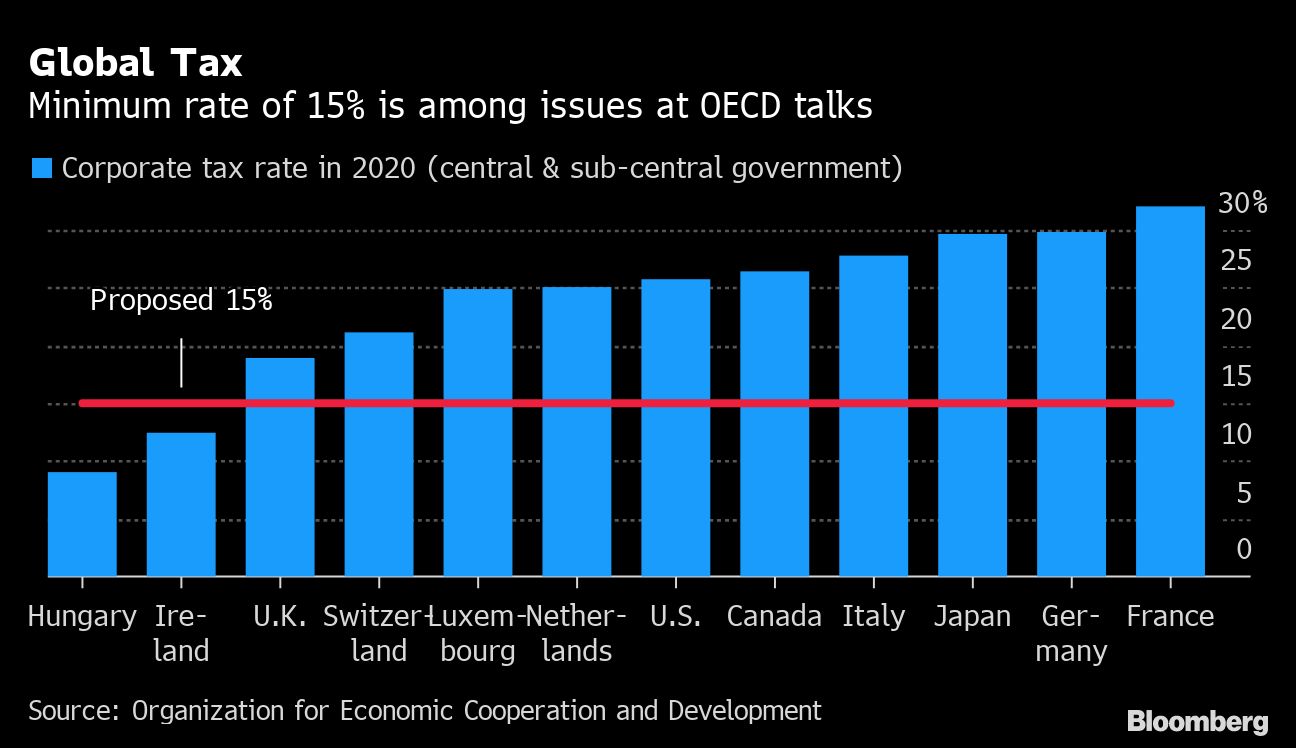

Corporate tax rate from 21 to 28 impose new global minimum taxes on corporations set a minimum 15 tax on income that large. The magnitude of the tax and revenue increases on the table is unprecedented. The government has today Friday 14 October announced that Corporation Tax will increase to 25 from April 2023 as already legislated for raising around 18 billion a year and.

Corporate Tax Rate in the United States averaged 3227 percent from 1909 until 2022 reaching an all time high of 5280. Quintile AGI cutoffs in 2022 Conventional Change in After-tax Income 2022-2031 cumulative total Dynamic Change in After-tax Income 2022-2031 cumulative total Dynamic Percentage Change in After-tax Income Long-run. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to 396 from 37 among other amendments.

The Tax Foundation estimated BBBA would raise 17 trillion of gross revenue over the next. Corporate Tax Rate From 21 to 28. The legislation that provided for this increase also sets out that.

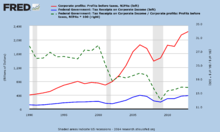

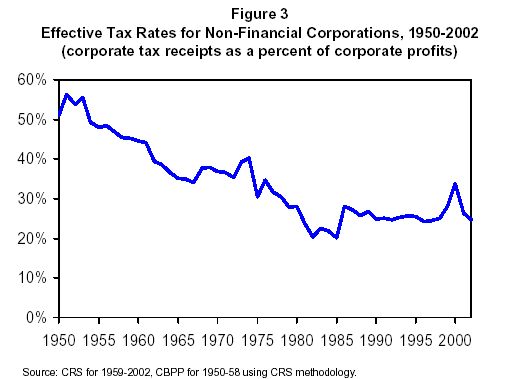

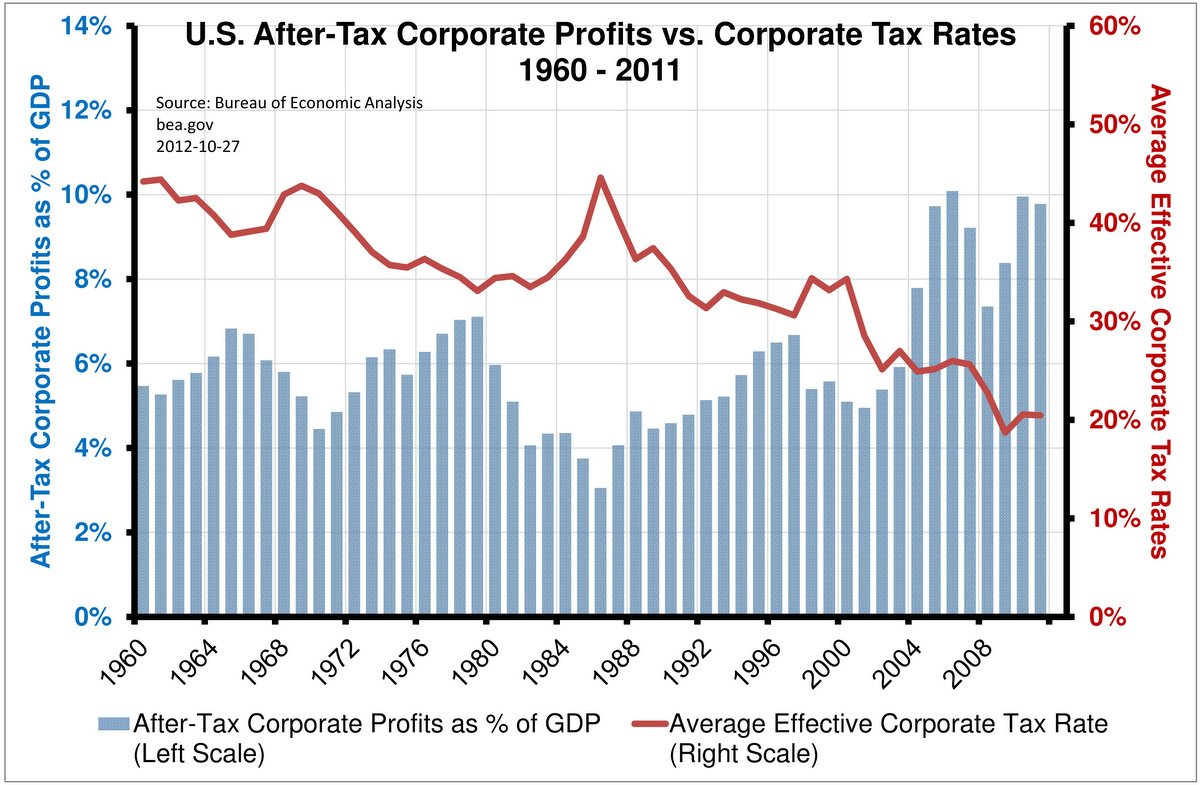

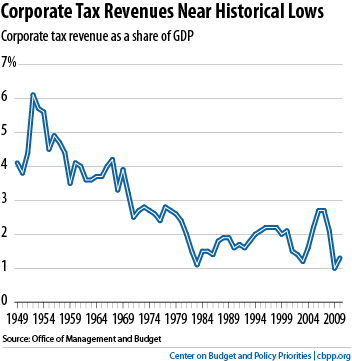

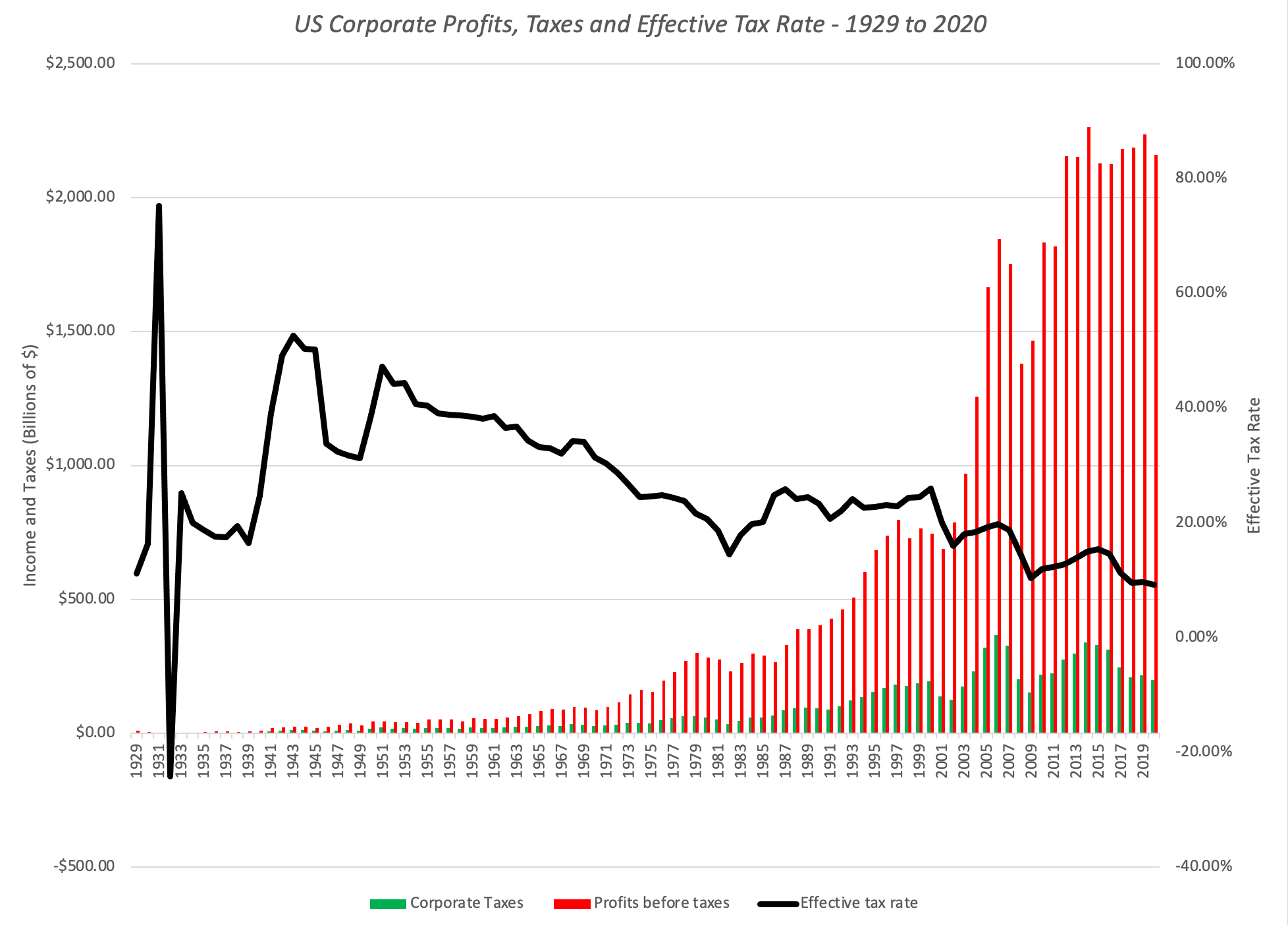

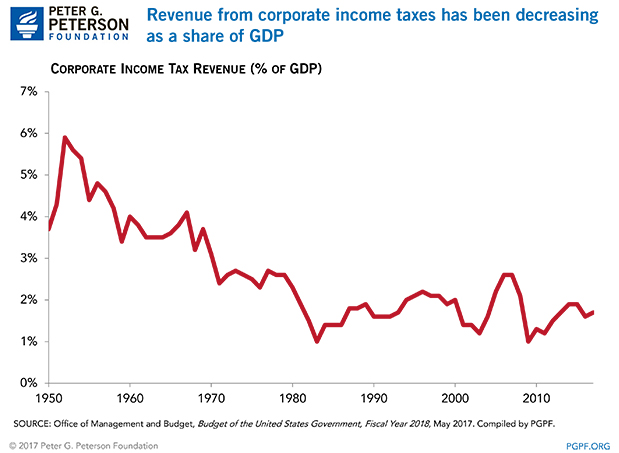

Also on homekpmg. Corporations paid lower taxes despite the fact that the. The Cumulative Effect of a 28 Percent Corporate Tax Rate on After-tax Incomes.

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum tax. In 2017 when corporations were subject to a. Proposed Increase of the US.

Proposed Increase of the US. Biden wants to increase the US. The American Jobs Plan includes tax incentives for clean energy and domestic manufacturing while the Made in America Tax Plan contains corporate tax increase.

The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations. This is true for many years and even up to the time that the earnings are returned to America. The Government notes that.

The Corporate Tax Rate in the United States stands at 21 percent. President Bidens proposal to raise the corporate tax rate to 28 percent reversing only part of the 2017 rate cut would help make the tax code more progressive and help. The increase in the corporate tax rate in the USA and the consequences for companies.

U S Lags While Competitors Accelerate Corporate Income Tax Reform Tax Foundation

U S Corporate Tax Rate Poised To Become Highest Mar 27 2012

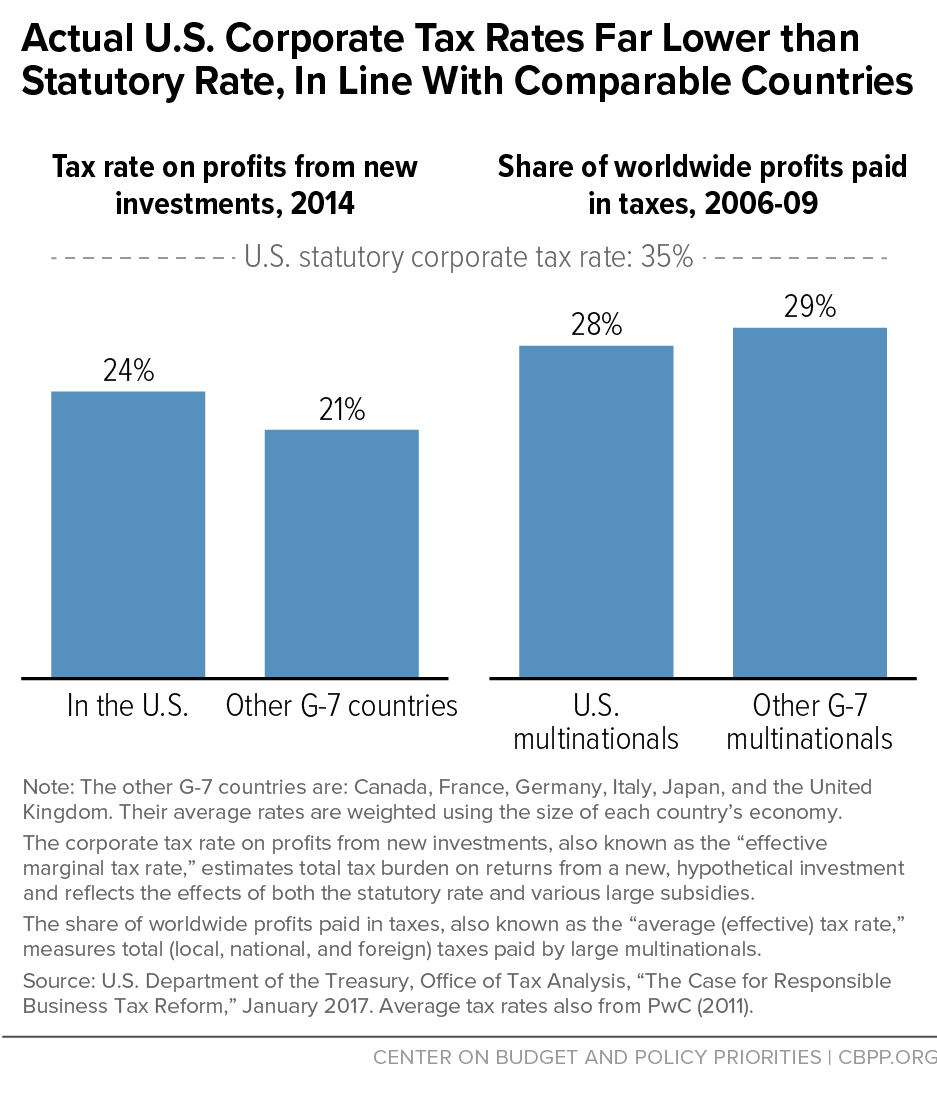

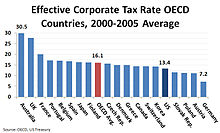

Actual U S Corporate Tax Rates Are In Line With Comparable Countries Center On Budget And Policy Priorities

Global Minimum Tax May Not Make It Past The U S Congress Treasury Risk

Tax Foundation On Twitter President Biden S Americanjobsplan Would Increase The Federal Corporate Tax Rate To 28 Which Would Raise The U S Federal State Combined Tax Rate To 32 34 Higher Than Every Country In

Little Known Fact Corporate Tax Rates Have Been Decreasing For Decades Economics On The Brain

What Should Corporate Tax Reform Look Like Center On Budget And Policy Priorities

11 Charts On Taxing The Wealthy And Corporations Inequality Org

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

The Corporate Tax Burden Facts And Fiction Seeking Alpha

Five Charts To Help You Better Understand Corporate Tax Reform

Increasing America S Competitiveness By Lowering The Corporate Tax Rate And Simplifying The Tax Code Mercatus Center

Five Charts To Help You Better Understand Corporate Tax Reform

Effective Corporate Tax Rates The New York Times

Impact Of Lower Corporate Tax Rate The Leuthold Group Commentaries Advisor Perspectives

Doing Business In The United States Federal Tax Issues Pwc

Corporate Tax In The United States Wikipedia

25 Percent Corporate Income Tax Rate Details Analysis

Corporate Tax Rate Of Non Territorial Oecd Countries Mercatus Center