tax avoidance vs tax evasion south africa

It therefore looks like tax avoidance and tax evasion are closely related. Using unlawful methods to pay less or no tax.

High compliance costs 15 32.

. For someone to be found guilty of tax evasion there must have been an. Low level of voluntary tax compliance 14 311. Diuga highlights the difference between evasion planning and avoidance.

Tax evasion does not always take the. It therefore looks like tax avoidance and tax evasion are closely related. Diuga highlights the difference between evasion planning and avoidance.

Usually this constitutes fraud ie. No reasonable grounds for tax position taken 50. Weak enforcement of tax laws.

Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion. Using unlawful methods to pay less or no tax. It therefore looks like tax avoidance and tax evasion are closely related.

The two terms can be confusingly similar but there is an important. Using unlawful methods to pay less or no tax. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven.

Usually this constitutes fraud ie. Standard models of taxation and their conclusions must reflect these. Using unlawful methods to pay less or no tax.

Usually this constitutes fraud ie. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under. What are the punishments for tax evasion.

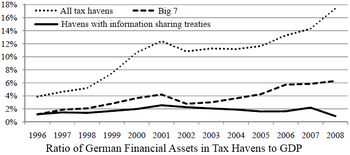

Tax avoidance and evasion are pervasive in all countries and tax structures are undoubtedly skewed by this reality. Intentional tax avoidance 150. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021.

Low tax morale 14 312. The two terms can be confusingly similar but there is an important. Usually this constitutes fraud ie.

Reasons for tax evasion and tax avoidance 13 31. Tax evasion is a punishable crime that can result in fines of up to 200 percent of the cost of the tax evaded. Diuga highlights the difference between evasion planning and avoidance.

Using unlawful methods to pay less or no tax. Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

While tax evasion was generally regarded as an illegal. Diuga highlights the difference between evasion planning and avoidance. The two terms can be confusingly similar but there is an important.

Gross negligence 100. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021. Diuga highlights the difference between evasion planning and avoidance.

Impermissible avoidance arrangement 75.

Taxing Wealth In A Context Of Extreme Inequality Legacy The Case Of South Africa Cepr

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Public Policies And Tax Evasion Evidence From Saarc Countries Sciencedirect

Pdf Morality Associated With Fraud Corruption And Tax Evasion In South Africa

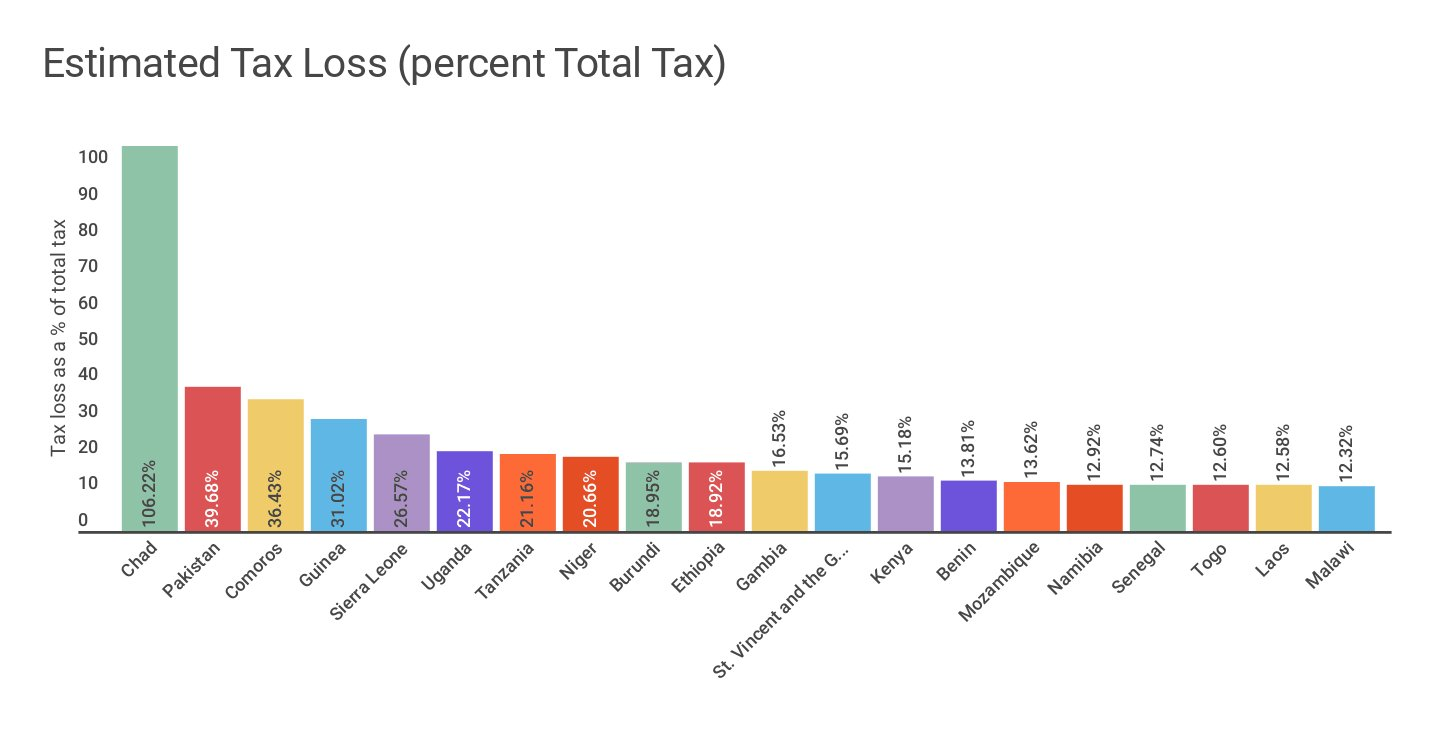

Global Distribution Of Revenue Loss From Corporate Tax Avoidance Re Estimation And Country Results Cobham 2018 Journal Of International Development Wiley Online Library

Pdf The Impact Of Tax Evasion And Avoidance On The Economy A Case Of Harare Zimbabwe Tatenda Dalu Academia Edu

The Sources And Size Of Tax Evasion In The United States Equitable Growth

The State Of Tax Justice 2021 Eutax

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

The Difference Between Tax Avoidance And Tax Evasion South African Tax South African Youtuber Youtube

Full Article The Relationship Between Tax Transparency And Tax Avoidance

Tax Avoidance Is Not An Unequal Evil On Google S Side Rolling Alpha

Tax Morale And International Tax Evasion Sciencedirect

Tax Planning And Tax Avoidance Difference Between Tax Planning And Tax Avoidance Youtube

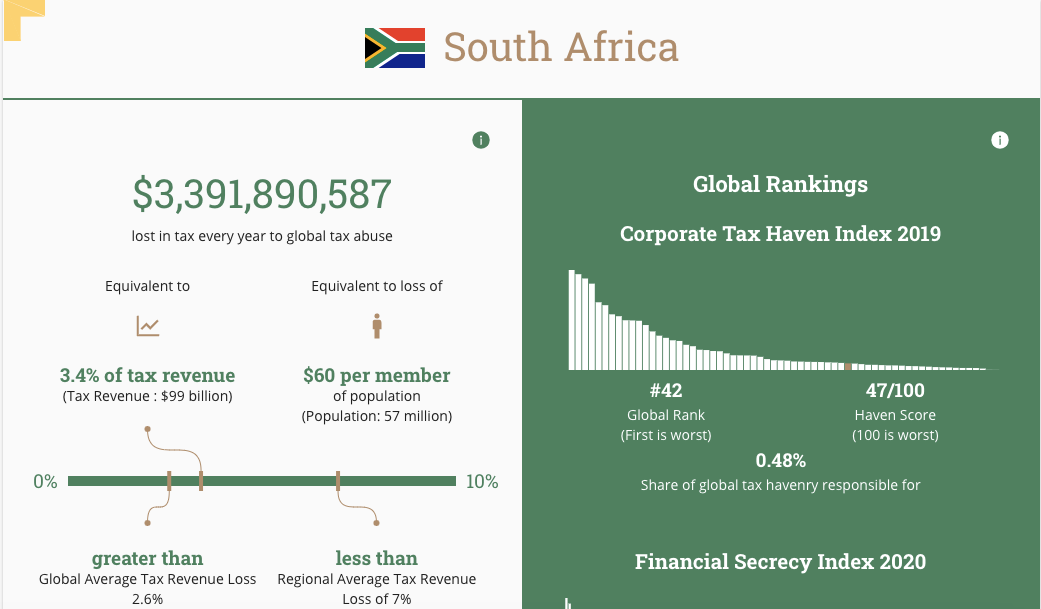

South Africa Loses Us 3 4 Billion Every Year Due To Tax Evasion

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax